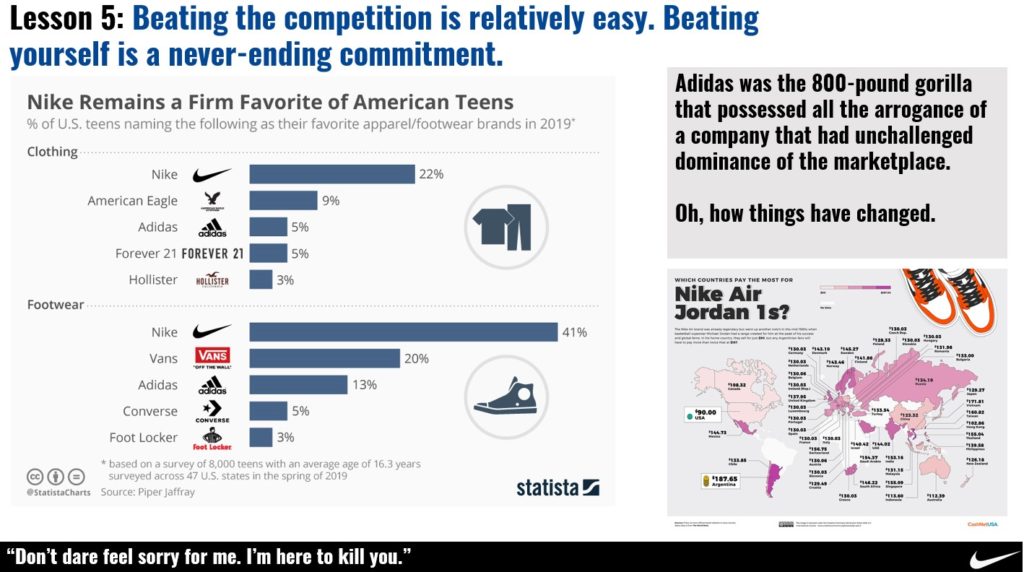

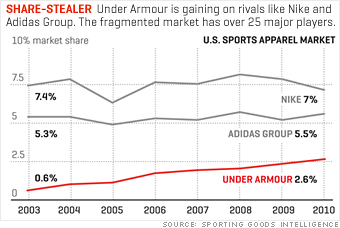

When you are sitting in second place looking up at the $28 billion revenue behemoth that is Nike you have to take risks and place strategic sponsorship bets. In 2010, Under Armour had approximately 2.6% of the total U.S. sportswear market.

Five years later at roughly $3.8 billion in revenue (projected this year revenue), Under Armour now sits in the No. 2 position within the extremely competitive U.S. sportswear market with a majority of that growth attributable to its meteoric rise in apparel sales. And with a bit of good fortune on some of its recent sponsorship bets, Under Armour is poised to offer a serious challenge to Nike’s dominance in the U.S over the next decade.

So in 2013 while Nike and Rory McIlroy were inking a 10-year estimated $200-$250 million deal, Under Armour took a risk and signed the 18 year-old newly turned pro to a multi-year endorsement deal for an undisclosed sum. And boy has that risk paid off for them in a big way.

At the ripe ole age of 21, Jordan Spieth has already won the Masters and the U.S. Open, and he has become just the sixth golfer to do so and only the second golfer in the last 44 years to accomplish this feat in the same year.

When you also consider overall popularity metrics, Jordan Spieth and Under Armour are simply killing it

[1]:

35% of consumers knew who Spieth was before the U.S. Open, up from just 19% before the Masters

In “overall appeal/likability” Spieth rose from No. 1,500 to No. 129 out of 3,600 celebrities

In terms of consumers aspiring to be like certain celebrities, Spieth is No. 1 among athletes and jumped from No. 333 to No. 4 overall, trailing only Tom Hanks, Bill Gates, and Kate Middleton.

In terms of “endorsement value” Spieth is No. 5 overall and No. 2 in sports, trailing only Michael Jordan

Spieth signed at the beginning of this year (before he won his two majors), is the simple stroke of genius … and luck that Under Armour needs if it’s going to make a dent in the Nike dynasty.

With Spieth locked down until 2025, Under Armour Golf is poised to lead the way in the golf apparel industry for the next decade. And if the sales velocity and demand of the UA Drive One shoe is any indication, Nike’s pedestal is getting slightly less sturdy.

Under Armour Website as of August 12, 2015. The Jordan Spieth UA Drive One is still sold out!

Stephen Curry

In 2013 when Nike passed on renewing his sponsorship contract and decided that Curry wasn’t deserving of a signature shoe, Under Armour welcomed him with open arms. With limited presence in the basketball shoe arena, Under Armour was looking to make a bigger play in this market. At the time, Curry was an exciting player but in Nike’s eyes he wasn’t necessary a superstar or franchise athlete “worth” investing large endorsement dollars in. Good thing Under Armour thought differently.

This past year, Stephen Curry averaged 28.3 points per game, shot 42.2% from 3, and won the NBA’s Most Value Player.

He also led the Golden State Warriors to their first NBA title since 1975.

Stephen Curry is second only to LeBron James in popularity, as evidenced by his #2 ranked selling jerseys on NBA.com.

Similar to the Under Armour Drive One Golf Shoe, Under Armour’s signature basketball shoe, The Curry One, is all but sold out. Not bad for your first basketball shoe!

Under Armour has a grand plan to turn their partnership with Stephen Curry into a $1 billion business alone and if they succeed, the $4 million a year they are paying Curry will look like chump change and continue to add fuel to the fire of Under Armour as they march along and try to continue to take market share from Nike.

On the horizon: The Texas Longhorns?

With Notre Dame already in the bag at a cool $90 million 10-year deal, Under Armour is now turning its eyes to one of the more historic/iconic college brands in America. Like it or not, the University of Texas rain or shine, lose or win year over year is an absolute cash making machine. With annual revenues of approximately $166 million, the University of Texas would be the ultimate coupe from Nike.

In May of this past year, it was reported that Under Armour made a $150 million offer over 10 years to the Texas Longhorns. While this may seem like a large sum of money for a collegiate program, Nike recently coughed up a cool $169 million to sign the University of Michigan to a long-term 10-year deal.

With a current roster of 13 other schools (Auburn, Hawaii, Maryland, Texas Tech, Boston College, Utah, Northwestern, St. John’s, Navy, Colorado State, South Florida, South Carolina, and Notre Dame), adding the University of Texas would the whale that they would need to bag to continue their meteoric rise.

Quick side note: Jordan Spieth went to the University of Texas. You think Kevin Plank isn’t chomping at the bit to use that in his negotiations with the Longhorns!

Imagine what the University of Texas vs. Notre Dame opening game next year in Austin would look like if both those teams were wearing Under Armour uniforms and both teams good again… I know Kevin Plank is dreaming of that day (as am I, especially in regards to the Longhorns being good but that’s for another blog post.)

Summary

At roughly $400 million (about 10% of total top-line revenue) in total sponsorship commitments this year, Under Armour is continuing its aggressive investments in high profile endorsement deals in an attempt to chip away at the empire that has been built by Nike. You often times have to spend money in places that you never would have considered in order to hit the jackpot and Under Armour’s two very risky strategy bets on Jordan Spieth and Stephen Curry are paying off in a huge way.

There is simply no denying that Under Armour is on fire and Nike must really consider the validity of their threat. This year Nike is planning on spending roughly $7.1 billion (about 25% of total top-line revenue) on total sponsorship commitments. When you add to this the $1 billion deal it just inked with the NBA in June, Nike is trying to combat Under Armour’s rise.

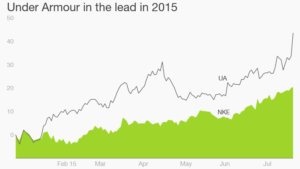

With other deals on the horizon, Under Armour is poised to continue to make serious runs at Nike, and while it seems unlikely that they will completely catch Nike there is no reason to doubt that this company won’t be a $6 to $10 billion company in the next decade.

This year Under Armour’s stock hit an all-time of $98.46. Not bad for a company that IPO at $6.33 in 2005.

Click Clack Nike hears you coming!