Purpose of this article: (1) to show the average retail markup on Green Smoothies and Clean Juices, (2) a solution to save money by making these items at home, and (3) the financial decision making concept of payback period.

Overview

About a year and a half ago I go a NutriBullet PRO, and like most gifts like this, I planned to make the “most out of it”. Unfortunately much like my Latte Habit, I continued to buy store made smoothies from the variety of shops we have here in Charlotte.

Fast forward to 2020, and the resulting shutdown due to COVID-19, and store bought smoothies suddenly became obsolete. Life has a funny way of sometimes making and/or forcing you to appreciate the things you have. And the global pandemic did exactly that for my NutriBullet PRO.

Since pretty much the start of lockdown in March of 2020, my wife and I have adopted a daily Green Smoothie habit; brought to us by none other than the same NutriBullet PRO that originally sat in the kitchen pantry gathering dust. What started as a simple trial has now blossomed into a daily enterprise of good health decisions: (1) a daily green smoothie from our NutriBullet followed by (2) a clean juice from our Aicok Juicer:

The following is my attempt to calculate the financial benefits that have accrued to us as a result of switching to home made green smoothies and clean juice.

Estimated Cost of a Homemade Green Smoothie & Juice

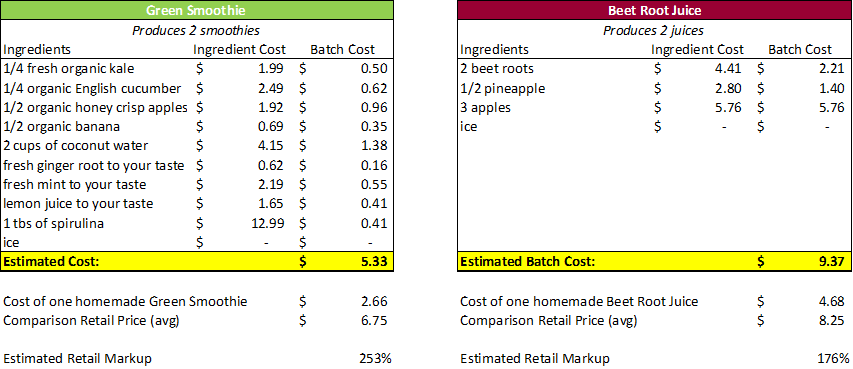

Our two go-to recipes for green smoothies and clean juice are as follows:

Using the menu of one of my favorite smoothie and juice establishments here in Charlotte I get an average retail price of $6.75 and $8.25 for smoothies and juices respectively. This represents a markup of +176% to $253% on average!!!

Use the Concept of Payback Period to Evaluate

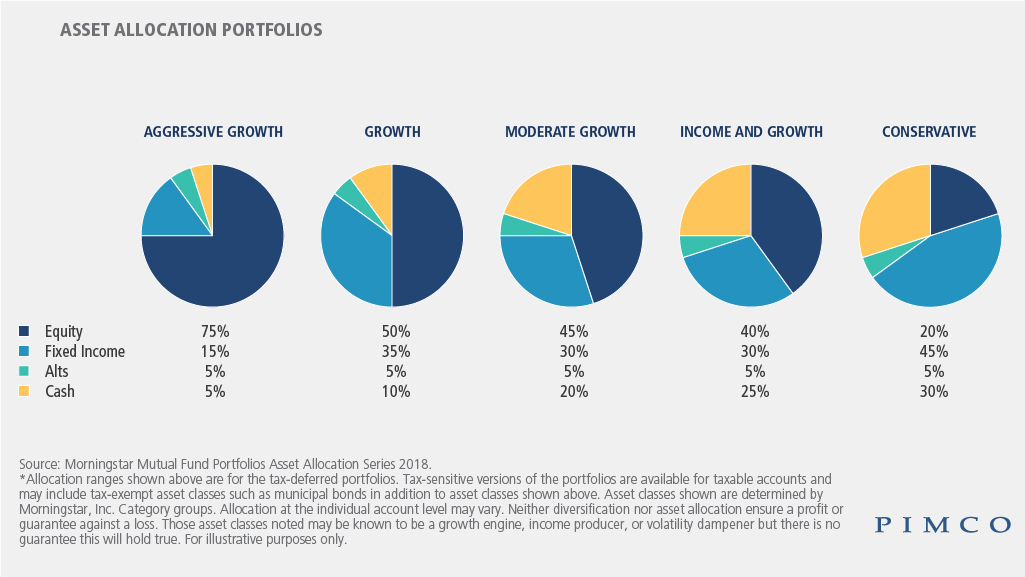

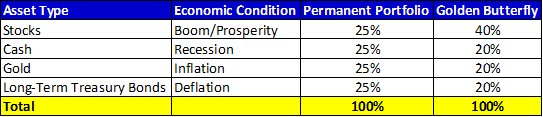

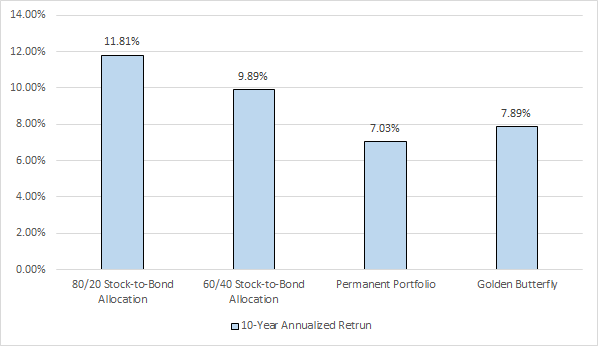

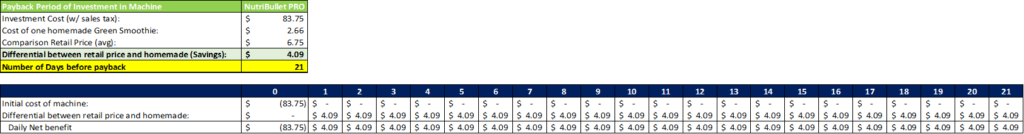

When deciding whether or not to buy a new machine for our house, analyzing the payback period can be an effective financial decision making tool. Most of the time when considering such investments or purchase decisions, the time value of money should be applied to your analysis. This simply means that you should consider the fact that your money today is worth more than that same sum of money in the future due to the fact that your money today can earn interest or a return.

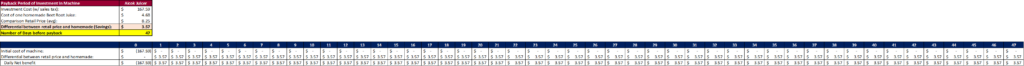

Sometimes though when the investment decision is simple and involves relatively smaller sums of money, analysis of the payback period can be a suitable alternative. The payback period is the amount of time it takes you to recover the initial cost of an investment or purchase. You calculate this by dividing the amount of the original investment by the annual cash flow or net benefit (in the case of my green smoothie/juice machines) derived from the investment.

Using the concept of payback period, lets analyze my Green Smoothie and Juice Machines:

Besides the obvious health benefits of our daily Green Smoothie and Clean Juice habit, the financial implications are immense. After investing in a NutriBullet Pro, it will take roughly 21 days of Green Smoothies to payback the cost of the machine.

By contrast yet still positive, after investing in an Aicok Juicer, it will take roughly 47 days of Clean Juices to payback the cost of the machine.

There is just no denying how value add both machines have been to our lives both from a health standpoint and a financial standpoint. It’s a no brainer given how quickly both machines payback the original cost when compared to purchasing these items at retail stores.