Purpose of this article: to give you a strategy based on a recent book I read to get out of debt fast and sustainably. Please note that we are not paid to recommend books like this, and our decision to do so is solely based on our positive experience with the material.

Bullet Point Summary

- The strategies detailed within are based on the book “The 2% Rule to Get Debt Free Fast.”

- The main focus of this approach: make incremental 2% changes to the way you behave with money over time.

- Put even simpler, for every $100 you spend monthly, see if you can reduce that amount by $2. Then rinse and repeat for the next month.

- Much like gradual fitness or diet improvement plans, The 2% Rule is designed to make you gradually better each month with money, 2% at a time.

- Small cuts can go a long way and the strategies detailed within The 2% Rule leverage this.

Overview

I recently completed a book by the founders of The ThrifyCouple.com called The 2% Rule to Get Debt Free Fast. And while the content was far from earthshattering, the strategies detailed within are simple, effective, and sustainable for anyone trying to get out of debt. In essence, the thesis of this book is to simply make incremental 2% changes to the way you behave in regards to your money. The following article is a deeper dive into the concepts discussed within this book. My hope is that after reading this post, you will be enticed to read the book, and pick up some strategies to help you along your get-out-of-debt journey.

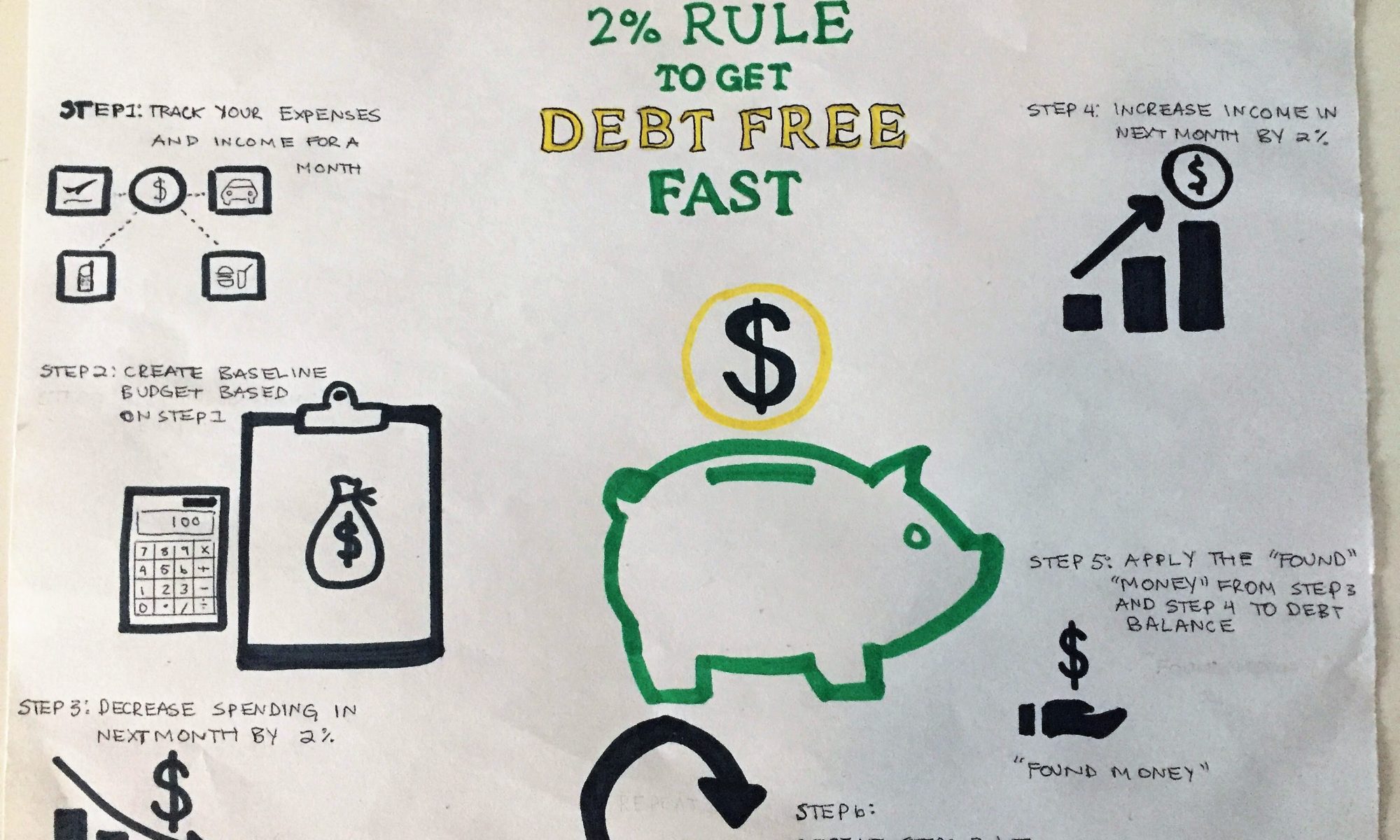

Start with Six Small Steps

The 2% Rule to Get Debt Free Fast starts with the following six small steps:

- Track your expenses and earnings for a month

- Create your baseline budget based on the results from Step 1

- Decrease spending the following month by 2%

- Increase income the following month by 2%

- Apply the “found money” from Step 3 and Step 4 towards your financial goal of getting out of debt

- Each month repeat Steps 3 through 5

By tracking your expenses and earnings for one month, you will get a feel for what you normally spend and make each month. From there you can then start to implement the incremental 2% improvements that the strategies in this book call for.

Six Small Steps in Action

Using the six small steps and a sample Client A, this is what the 2% Rule looks like in action:

- Step 1 & 2: For the month of November 2018, total income and total expenses for sample Client A were exactly $3,000. As a result, the “found money” was $0.

- Step 3: The planned expenses for December 2018 are $2,940 which is 2% lower than November 2018 baseline

- Step 4: The planned income for December 2018 is $3,060 which is 2% more than November 2018 baseline

- Step 5a: Actual income and expenses for the month of December 2018 created a “found money” positive gap of $120. It’s important to note that Client A still obtained a $120 “found money” positive gap even though their income didn’t increase. This is because Client A reduced their expenses by more than the 2% plan.

- Step 5b: Use “found money” positive gap to pay down debt. Remember that your monthly expense already includes a debt paydown in there. So this positive “found money” gap is incremental payments on top.

- Step 6: Apply the same 2% increase in income and 2% decrease in expenses to the actuals for December 2018. Rinse and repeat every month from here until you crush your outstanding debt balance.

Why This Approach Works?

This strategy works simply by leveraging the laws of incremental positive change. The focus each month is to simply be 2% better than you were the last month. This plan is designed in such a way to help you use gradual progress to meet your financial goal of getting out of debt. Other get-out-of-debt strategies require you to make drastic cuts that can really only be maintained for brief intervals. It’s like all of those fad/crash diets when you are trying to lose weight.

Instead, the 2% Rule gives you a gradual approach towards cutting your budget and expenses that can actually result in a more realistic plan that works. In closing, if you are motivated to begin your debt payoff journey and are looking for a strategy that may benefit you, please check out the 2% Rule to Get Debt Free Fast. It gives you a very good roadmap to follow towards debt freedom and also has a tone of other long-term financial goals and objectives. I highly recommend this book because of its simplicity and high degree of likelihood to be followed.

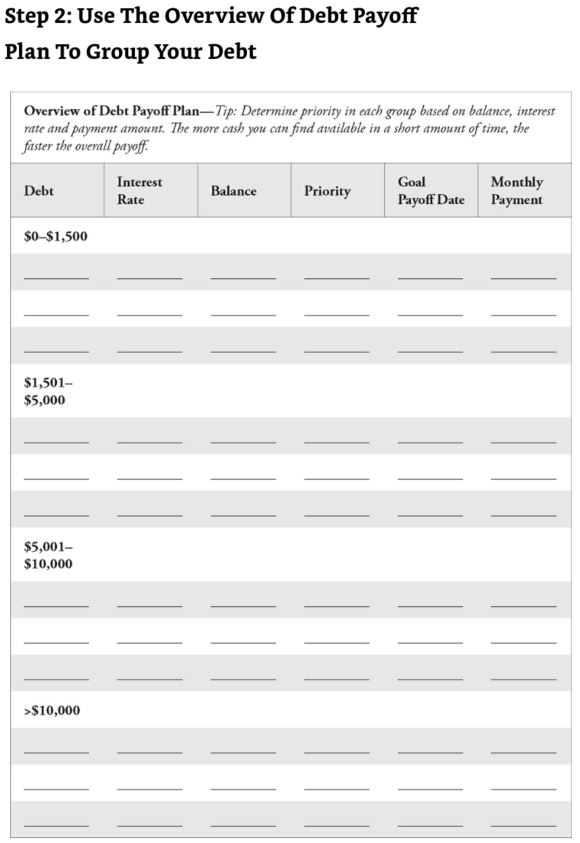

Usefull Materials – See Below