“With 50% of clubs losing money we need to stop this downward spiral. They have spent more than they have earned in the past and haven’t paid their debts. Continued excessive spending has been justified by club executives as being necessary to keep competitive but it is this excess spending that has brought a number of clubs to the brink of financial ruin. This needs to stop and Financial Fair Play Regulation is the means.”

-UEFA President Michael Platni

Introduction

UEFA’s Financial Fair Play Regulation (FFP) was first agreed in principle in September of 2009 after a review showed that more than half of the 655 European clubs suffered an operating loss over the previous year. Introduced amid concerns regarding the heavy spending of a number of professional clubs across Europe, FFP in principle will attempt to prevent professional football clubs from spending more than they earn in the pursuit of success. Set for complete implementation for the 2014/2015 UEFA season, clubs will be forced to comply with FFP or face a variety of sanctions, the ultimate penalty being disqualification from the lucrative Champion’s League. For the biggest clubs within the English Premier League, what is really at stake is £60m in prize money and television rights given to the winner of UEFA’s Champions League.

Principles within UEFA’s Financial Fair Play Regulation

The basic principle behind FFP is for a football club to spend no more than it earns in a given fiscal year. For a football club, turnover (income) is generated through ticket sales, television revenue, advertising, merchandise sales, player sales, and prize money from tournaments participated in, while expenses take the form of outgoing club transfers, employee benefits, and player wages. FFP takes a look at the revenue a club makes and the expenses a club sustains, and applies a threshold to determine compliance with UEFA regulations (see Figure 1 below). Money spent on long term investments like infrastructure, training facilities, or youth development academies are not included in the FFP evaluation. In theory, this principle is basic enough, but the reality is European football is about winning now at all costs and overspending breeds success.

Figure 1: Financial Fair Play Monitoring Periods and Thresholds

Compliance with UEFA’s Financial Fair Play Regulation

The first monitoring period of FFP covers the 2011-12 and 2012-13 fiscal years and compliance with FFP will affect the 2014/15 season. During this period of time, football clubs that sustain losses greater than £4.1m (€5 million) must obtain equity injections from their owners. In essence, the owners of the football club must be willing to back the losses greater than the initial threshold hold of £4.1m (€5 million). The max aggregate loss that a club can sustain during this first monitoring period is £37.2m (€45 million).

As of February 28th of 2014, UEFA announced that seventy-six clubs are currently under investigation for potential financial fair play violations and consequently UEFA has required these clubs to submit additional financial information. And in May of this year Paris Saint-Germ (PSG) and Manchester City were both slapped with roughly £50 million (€60 million) fines and a reduction of their squad to 21 players for next season’s Champions League.

Given the parameters of FFP, I will examine the current state of compliance by Chelsea F.C. and argue that FFP falls short and prevents future clubs from emulating Chelsea’s strategy for success, thus ensuring the continued dominance of Champions League by Europe’s footballing elite.

Case Study: Chelsea F.C. 2003 to the Present

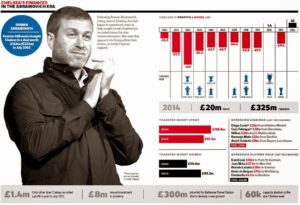

Since Roman Abramovich took control of Chelsea F.C. in 2003, the Blues have incurred heavy losses due to over spending and investing on new players and fresh talent. The Abramovich reign has brought in an estimated 80 different players at approximately £801m in gross transfer market spend[1](not including the additional £91.3m spent this summer on Cesc Fabregas, Filipe Luis, Loïc Rémy, and Diego Costa, and the £72.1m spent on the salaries for 10 different managers). As depicted by the graph below, Chelsea F.C. has spent heavy and often on players since 2003:

But during this time, this over-investment in players has led the Blues to unprecedented success on the pitch. Since 2003, Chelsea F.C. has won 3 Premier League Titles (2005, 2006, 2010), 4 FA Cups (2007, 2009, 2010, 2012), 2 League Cups (2005, 2007), and 1 UEFA Champions League Title (2012). During this time frame they have finished in the top 3 of the English Premier League in every single season apart from 2012, and they have reached the Semi-Finals of Champions four times (2004, 2005, 2007, 2009) also making it to the finals in 2008 against Manchester United.

To put this in context, Chelsea F.C. has won a total of 28 major trophies since the club’s inception in 1905 and 13 of these trophies have come since 2003. 46% of Chelsea’s all-time trophies have come in the span of 11 years and this meteoric rise to relevance is directly tied to the investments that Roman Abramovich has made.

As UEFA’s Financial Fair Play Regulation compliance continues to kick along, I can’t help but belief that implementation of FFP will prevent clubs outside of Europe’s elite from quickly rising to prominance. And given the penalties within FFP the days of Chelsea F.C. incurring huge losses due to overspending on players appears to be at an end.

Chelsea F.C. Key Financial Statistics: 2003 to 2014

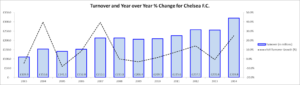

Utilizing financial information obtained from TheChels.co.uk[2], I have compiled the following charts of key financial statistics for Chelsea F.C.:

Since 2003, Chelsea F.C. have experienced a +10.2% CAGR in Annual Turnover due primarily to signficant increases in revenue from business partnerships/sponsorships (see 10-year, $450 million kit deal with Adidas), and this past year (fiscal year ending June 30, 2014) Chelsea F.C. recorded a record breaking £18.4m profit. This record profit for 2014 ensured that FFP regulations have been satisfied for the upcoming year.

For the first time in Chelsea F.C.’s financial history, the club finances a majority of their transfer spending with money generated by the sale of players. As an example, for the 2014/2015 summer transfer period (as mentioned above), Chelsea F.C. spent approximately £91.3m, but this sum was matched with approximately £75.2m in fees generated from the sales of David Luiz, Demba Ba, and Romelu Lukaku[3].

Chelsea’s financial maturity is also flowing into its overall valuation as Chelsea’s value has risen by +84.7% from approximately £275m ($555m) in 2007 to £508m ($868m) in 2014. It took the Blues 11 solid years to reach its current level of financial stability, and now that they have established themselves as one of Europe’s elite football clubs, they stand to benefit from the very sanctions that would have threatened their meteoric rise in 2003 had they been around. And this fact is my biggest beef with FFP!

Why FFP falls short of the Mark

Chelsea F.C. is now safe in the short-term from FFP sanctions simply because their frantic over spending and investment in players to establish themselves in Europe occurred during a time period when FFP sanctions were none existent. They are now reaping the benefits of this investment as they enter a period of financial stability and maturity, the likes of which, we haven’t seen in West London during the Abramovich era. Big clubs have already spent their money investing in talent before these regulations have come into play allowing them to solidify their positions within Europe based solely on the first mover advantage.

FFP simply put benefits the teams that are already economically powerful and already have deep histories with even deeper followers. Looking at the list of European clubs atop the Forbes valuation, you start to see pretty quickly it is a who’s who of stable elite:

Of the 59 winners of UEFA’s Champions League, the trophy has been won 37 separate times by one of the 10 teams on this list. 62.7% of the time, one of European’s elite clubs lifted the trophy. And when you stop to consider this fact, you realize pretty quickly that these FFP regulations are a “contradiction” only set up to serve and protect Europe’s biggest clubs[4]. On top of this, the fines that are compiled by UEFA from the violators of the Fair Play Regulations are then distributed back to the clubs who successfully complied with the rules; in effect further robbing Peter to pay Paul!

But while FFP regulation attempts to prevent football clubs from over spending, it has done absolutely nothing to prevent owners from saddling football clubs with massive levels of debt. Leveraged buyouts continue to load European football clubs with massive levels of debt as the result of debt financing by new owners, and FFP has done little to address this problem, which in my opinion is a much greater problem to the financial stability and future of European football. As of February 2014, the top 10 football clubs with the most amount of debt were as follows[5]:

The world’s second most valuable club, Manchester United is the number one club in terms of debt accumulation. And even though they pass FFP regulations hand over fist from a cash flow standpoint, 20.3% of their valuation is tied up in debt. So in essence, FFP penalizes football clubs like Chelsea, Manchester City and PSG who finance their operations solely by direct cash injections, and rewards football clubs like Manchester United and Real Madrid who finance their operations utilizing massive debt and money from massive sponsorship deals

UEFA’s Financial Fair Play Regulation originally set out to clean up the financial activities of Europe’s biggest football clubs but if falls short of this mark. Timing of investing activities has given Europe’s elite clubs a first mover advantage and regulations have done very little to tackle the debt carried by these large clubs. FFP simply benefits the football clubs who are willing to take on more debt over those clubs who finance their operations via cash. And it is this very punitive nature of FFP that is simply maddening. FFP has placed the “new clubs” at a disadvantage compared to the historically old big clubs, in this fight for European relevancy.

Disclaimer: I am a Chelsea F.C. supporter and the opinions expressed above are solely my own.