Purpose of this article: to help you quickly create and monitor your personal balance sheet.

Bullet Point Summary

- Before you can improve your current financial situation you need to figure out where you are. The personal balance sheet is a great tool to help you accomplish this.

- Personal Capital is my favorite personal finance app and piece of software to show net worth. It will speed up the gathering of your financial information, and will give you an awesome snapshot of your net worth every time you log in.

- The personal balance sheet gives you a better view of your total finance picture, better than a budget or net cash flow spreadsheet.

Overview

A personal balance sheet provides an overall snapshot of your net worth (or net wealth) at a specific period in time. It is a summary of your assets (what you own), your liabilities (what you owe) and your net worth (assets minus liabilities). The old business adage “what gets measured, gets managed” rings true in your personal finances as well. Without a personal balance sheet, it becomes very challenging to put forth effective short-term and long-term strategies to improve your finances.

Gathering the Necessary Data

Compiling the necessary financial information to create your personal balance sheet can be an arduous manual process especially if you are not using personal finance software like Mint or Personal Capital. So if you do at least one thing after reading this, start using some personal finance software today! Here is a link to reviews on some of the best personal finance software.

There are a ton of reviews comparing all of the ins and outs of each of the different personal finance apps and software, but my favorite by far is Personal Capital. In short, Personal Capital gives you the best view of your Net Worth, and does this quickly, accurately, and in real-time. Additionally, Personal Capital utilizes Yodlee to sync up to your various financial accounts, and thus has fewer reported sync issues.

It’s not a budgeting tool like YNAB or Mint, and it doesn’t help much with daily cash management (i.e. managing expenses, paying bills, alerts on overspend, etc.). It is though an effective aggregator that can help you manage your short-term and long-term views of your net worth.

Create Your Personal Balance Sheet

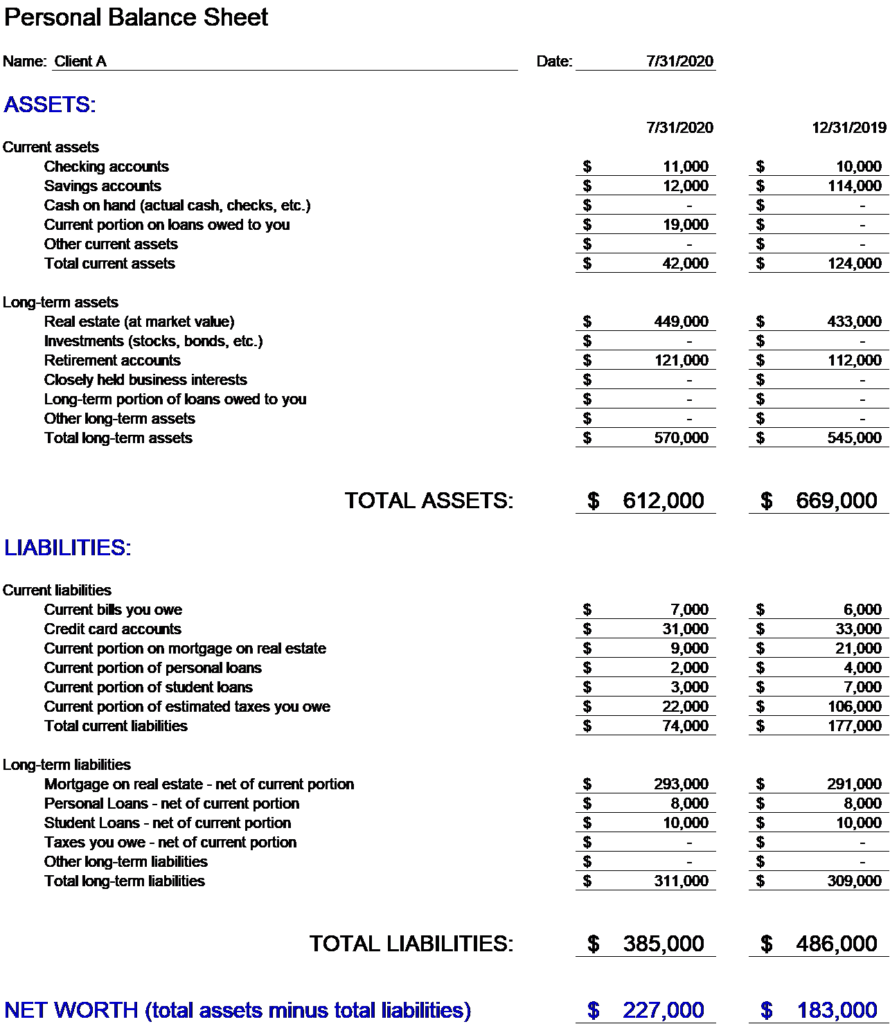

Using Personal Capital, the following personal balance sheet was created for Client A in less than 10 minutes:

All of the values for assets and liabilities are from the same day and thus reflect the same, single point in time for my client’s finances.

What Does It Actually Mean?

Now take a closer look at each column. Over the past seven months there has been a +24% increase in net worth as Client A’s net worth has grown from $183K to $227K. Back in December of 2019, the comprehensive financial strategy that was put in place focused on building retirement assets while steadily paying down liabilities owed, and thus far into the year this strategy is working for Client A.

In general, there isn’t really a magical solution that quickly changes one’s net worth position. Consistently executing your financial plan which usually entails some combination of savings, investing, and paying down debt is the tried and true strategy to increasing your net worth.

But before you can improve your financial situation, you need to measure your current starting point. The personal balance sheet is the best tool to help you do just that, and utilizing the financial app, Personal Capital, makes the compiling and tracking of this information seamless.

Personal Capital invite a friend link

You can download the excel file of the balance sheet template here: