Purpose of this article: to show how my afternoon latte habit adds up and give you some thoughts on things to consider if you have a similar financial habit in your life

Overview

I have a financial confession to make… I love afternoon lattes and it’s costing me dearly! And like many of you out there, I know every single time I buy my latte, I am overpaying severely. According to USA Today’s coffee calculator, the markup on my latte can be as high as 300% depending on the coffee shop. But I will not deny that there is something quite special about a hot off the press latte!

How Much Is My Latte Habit Costing Me?

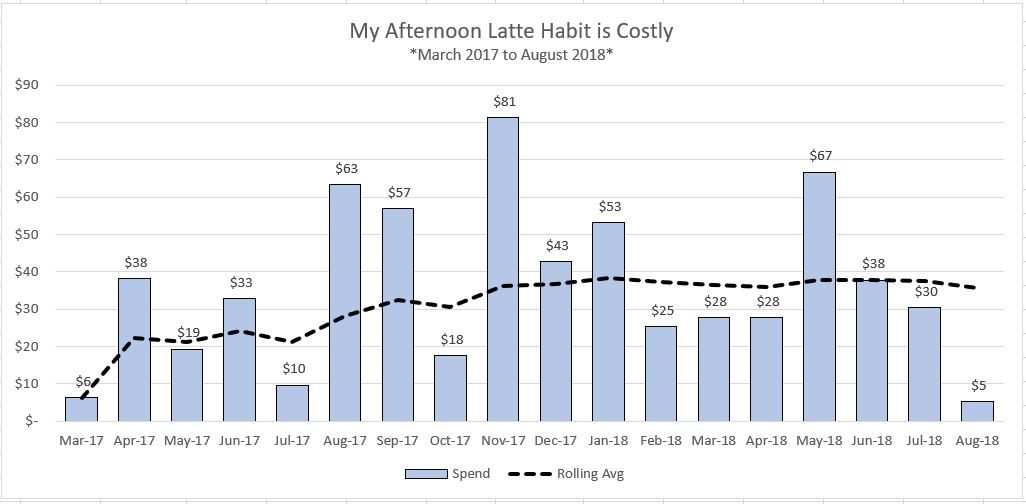

Based on an analysis of my spending over the last 535 days here are my financial stats:

• I have visited my local Charlotte coffee shops 71 different times, and have spent a total of $643 on afternoon lattes. The cost per trip is $9.04 (my goodness!)

• My average monthly spend over the last 18 months is $35.67

• The most I spent in one month was $81.23 in November 2017

• Over this time period, I spent roughly $1.20 a day on my latte habit.

At a 300% markup, my afternoon latte habit should have only costed $215 if I was disciplined enough to brew my own coffee. This is a difference of $428 extra that I have spent over the last 18 months.

What Could I have Done with the $428?

So, what could I have down with this additional $428? Here are a few things I could have done with that money…

• During the time period of 3/1/17 to 8/18/18 the S&P 500 returned an approximate +19.6%. Had I invested my $428 during this time period, I could be roughly $84 richer.

• Based on the Bureau of Transportation, I could have taken a round trip ticket to almost any US city. The average round trip price during the first three months of 2018 was $346.49.

• I could have used that money to pad my emergency savings account. Recent studies show that very few of us Americans have enough savings to cover a $1,000 emergency.

There are countless other more positive money management actions I could have pursued instead of spending this extra money on my afternoon latte habit. The point I am trying to make here isn’t to pass judgement on this money spending habits. It’s to make myself more aware of an area of spending that may not truly be worth it in the long run.

If you are like me, you probably have some areas of money management that you wish you were better at. I hope my financial habit confession was helpful for you to hear. Please let us know what financial habits you have and wish to break.