📚 Core Insight

- In leadership and business, setbacks are inevitable — you will have to give ground sometimes.

- But how you give ground determines whether you preserve future leverage or accelerate defeat.

- Strategic leaders retreat grudgingly: minimizing losses, signaling strength, and always setting up the next move.

- Survival and eventual success depend less on never falling — and more on falling without surrendering your ability to fight smart tomorrow.

Introduction

The Hard Thing About Hard Things by Ben Horowitz provides a raw and insightful account of the challenges faced by a CEO in the tech industry. Unlike many business books that offer formulas for success, Horowitz provides a realistic portrayal of the difficulties and complexities involved in building and leading a company. Drawing from his personal experiences, he shares practical advice and hard-earned wisdom that can benefit anyone involved in the entrepreneurial journey.

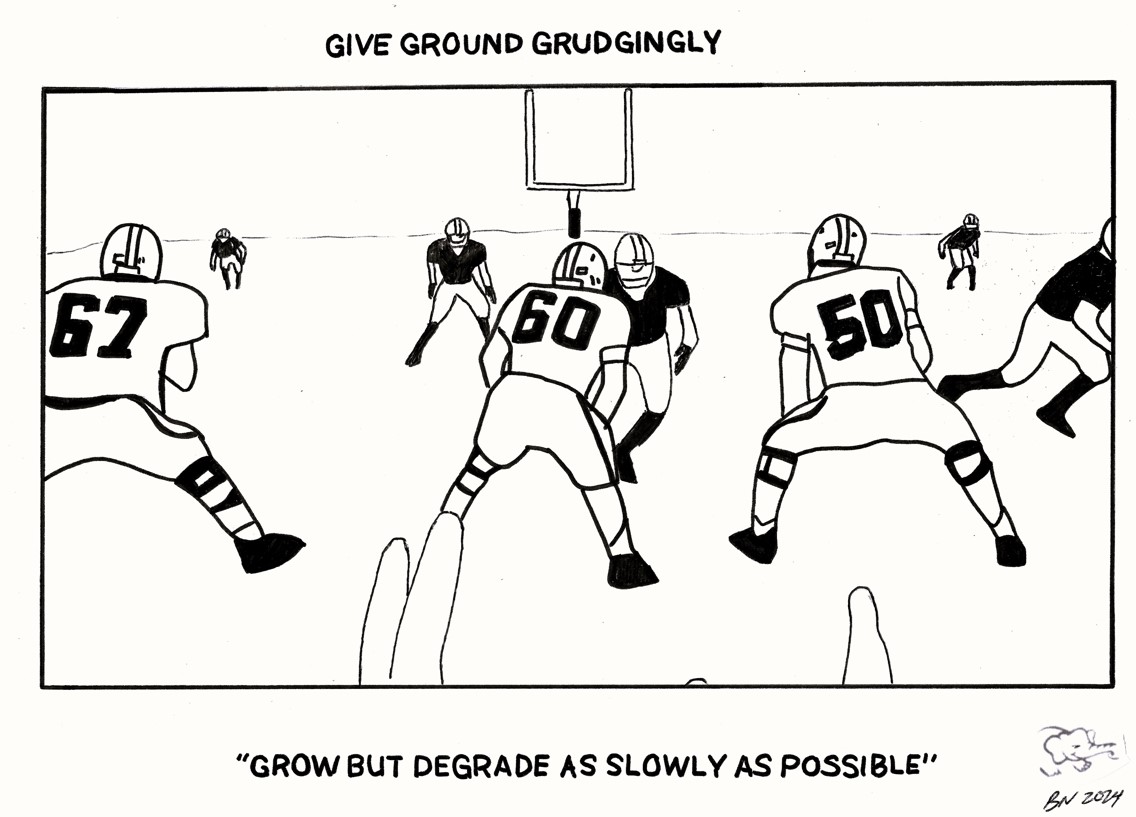

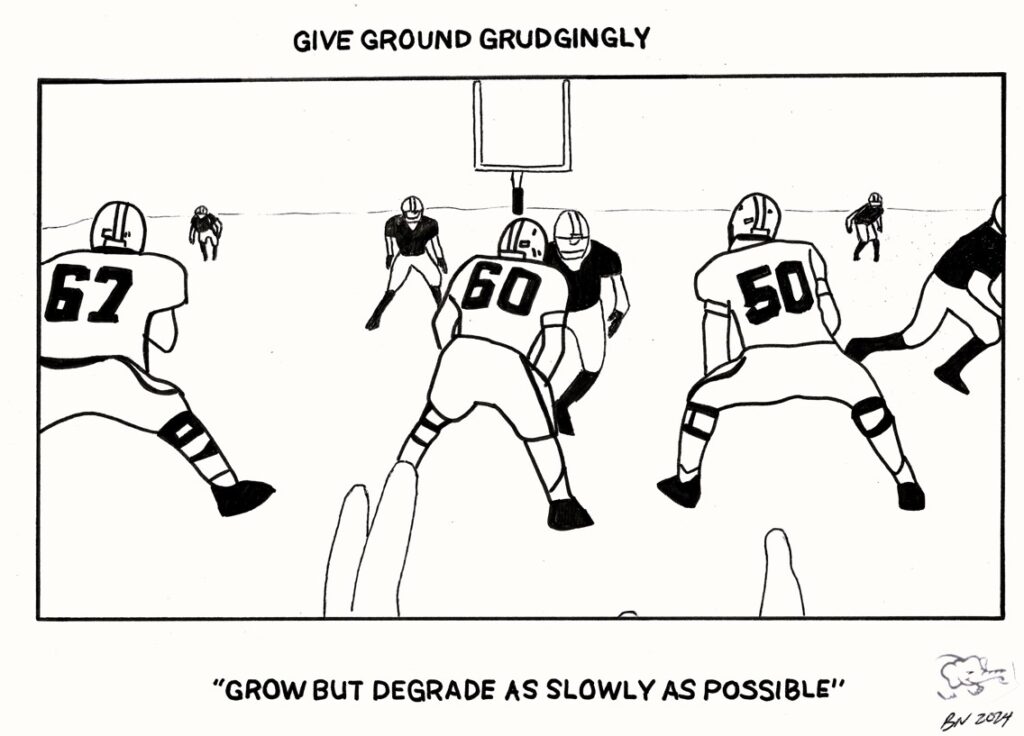

Give Ground Grudgingly

In “The Hard Thing About Hard Things,” Ben Horowitz introduces the concept of “Give Ground Grudgingly,” emphasizing maintaining growth while minimizing degradation. This principle advises leaders to make necessary sacrifices but resist unnecessary losses. It’s about finding the balance between expanding the business and preserving its core values and capabilities. Essentially, Horowitz is advocating for cautious and strategic growth, ensuring that as the company evolves, it retains its essential strengths and integrity, thus degrading as slowly as possible.

American Football Analogy

There is a great analog to this concept in American football. An offensive lineman’s job is to protect the quarterback from onrushing defensive linemen. If the offensive linemen attempt to do this by holding their ground, the defensive lineman will easily run around them and crush the quarterback. As a result, offensive linemen are taught to lose the battle slowly or to give ground grudgingly. They are taught to back up and allow the defensive lineman to advance, but just a little at a time.

When you scale an organization, you will also need to give ground grudgingly. Specialization, organizational structure, and process all complicate things, and implementing them will feel like you are moving away from common knowledge and quality communication. It is very much like the offensive lineman taking steps backward. You will lose ground, but you will prevent your company from descending into chaos.

Final Thoughts

In The Hard Thing About Hard Things, Ben Horowitz does not sugarcoat the entrepreneurial experience. Instead, he provides a genuine look into the grit required to lead a company through its toughest times. His insights are invaluable for current and aspiring leaders who seek to understand the true nature of building and sustaining a successful business. This book is a must-read for anyone looking to gain a deeper understanding of the complexities of entrepreneurship.

Download My Notes

Interested in diving deeper into Ben Horowitz’s work on The Hard Thing About Hard Things? Download my unfiltered notes below ?