Purpose of this article: to give you some tips to start repairing your credit score day by day thus improving your ability to borrow money on better terms and your overall financial well-being.

Bullet Summary

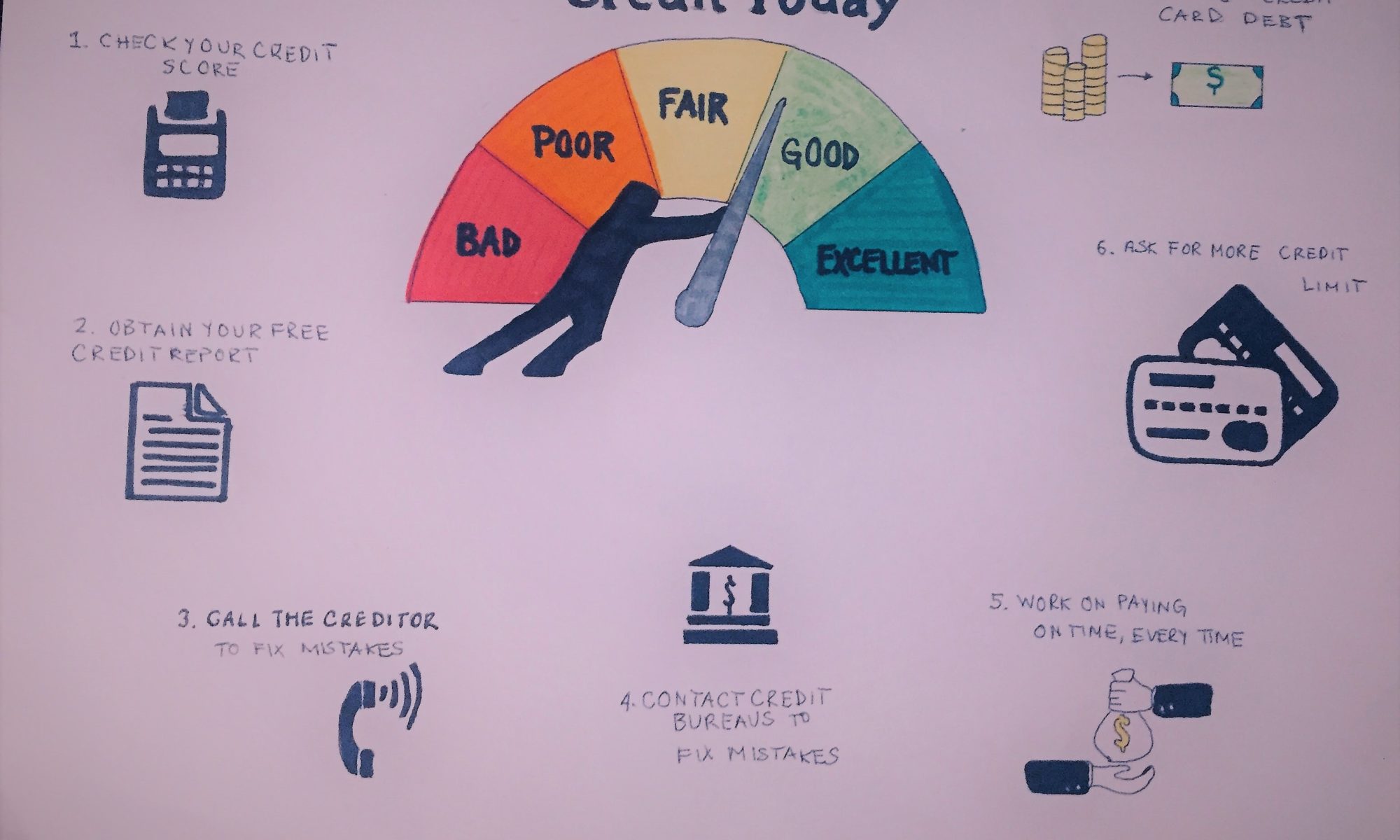

- Repairing your credit score takes some time. The following are the seven easy steps to start fixing your score today.

- Always start by checking your credit score

- Next obtain your free credit report and verify that the information is accurate. This will help you know your starting point.

- Call your creditors and contact the credit bureaus when mistakes are found on your credit report.

- Commit to paying your bills on time, every time as this is probably the single most important strategy

- Ask for more credit limit from time to time to reduce your credit utilization rate down to 30%

- Take out a personal loan to consolidate your credit card debt into one if you can.

Overview

Rome wasn’t built in a day. In fact, based on a Google search, Rome was built in 1,009,491 days. And repairing your credit won’t happen overnight. It’s a bit like losing weight: It will take time and there is no quick way to fix it, but you HAVE TO START NOW!

Your credit score is based on your credit history which is the sum of all your financial activities over the past 7 to 10 years. As you repair your credit history, your credit score will naturally improve over time. But for most of us, we only think about our credit score right before we need to take out a new loan. The following article will hopefully help you take some pre-emptive steps toward repairing your credit score now.

The First Step is Knowing Where You Currently Stand

The time to start repairing your credit score is well before you really need it. But before you can actually take steps to improve your score, you need to know where you stand. There is only one true way to know where you stand and that is to pull your credit report from one of the three credit agencies: TransUnion, Experian, and Equifax.

You can obtain your free annual credit report from the following link here.

Once you obtain your credit report and review it thoroughly, you will have your starting point from which you will hopefully improve. For more information on the importance of your credit score please see our article entitled “Your Credit Score … Three Digits Can Mean A Whole Lot.”

Next Step is to Fix the Mistakes on Your Report

The unfortunate reality of financial life is mistakes happen. And while you and I both are perfectly infallible human beings (kidding of course) the credit agencies are not.

The most common mistake that shows up on your credit report and drags your credit score down is incorrectly entered late payments.

This occurs when a credit card provider or a mortgage lender fails to enter a payment correctly and/or timely.

Payment history is a significant factor in your credit score. Remember that over 65% of your credit score is based on your payment history and how much credit you have used up (credit utilization). Given this it is vital that you ensure all your payment history entries on your credit report are accurate.

When you find a payment entry that is incorrect (i.e. applied late), dispute this with either the creditor or the credit bureau directly. You can also move all of your credit payments to auto draft from your bank account to ensure that the payment is issued to the creditor/lender on time. At minimum, you should have all your minimum payments on auto draft so that you can ensure that your payments are processed on time, EVERY TIME!

Ask to Remove Negative Comments

You have probably heard the saying: “You get more with sugar than with salt.” And in dealing with the credit agencies and creditors this couldn’t ring truer. When you have a negative comment on your credit report for say a late payment, you can simply call up your creditor and ask them nicely to remove the negative comment. I kid you not, but plenty of our clients have been able to remove negative marks from their credit history by simply playing nice.

This is simply because creditors have the power to instruct the three credit agencies to remove entries from credit reports for any reason at any time. Put another way, your creditor can decide whether or not to grant you mercy simply by how you ask for “forgiveness.” So, if you do anything at all, please start by calling up all of your creditors and playing nice with them to see if they will remove negative comments/remarks for late payments and other derogatory actions from your credit report.

And While You’re Asking for Things … Ask for More Credit Limit

As we mentioned above, over 65% of your credit score is based on your payment history and how much credit you have used up (credit utilization). Asking for more credit limit will decrease your credit utilization and increase your credit score. Credit Karma has a great step by step on how to ask for more credit limit.

The bottom line is if you have bad credit already, asking for more credit limit will be tough but it is still worth doing because every extra dollar of new credit limit will improve the ratio of credit utilization which will positively impact your credit score. You just have to ensure that you don’t use up the additional available credit should you be approved.

Use a Personal Loan to Consolidate Multiple Credit Card Debt into One

At first glance, the idea of taking on more debt to pay off credit card debt might seem counter intuitive. But the reality is a personal loan can help you consolidate all of your current credit card debt into one single payment, usually at a lower interest rate.

A personal loan works as follows:

- You borrow funds from a creditor at an interest rate that is usually lower than the interest rates charged by your credit card provider.

- You then use the funds to pay off your credit card balances.

- Over time, you pay back the personal loan and thus reach a state of debt freedom

Personal loans are typically unsecured which means they don’t require the borrower to put down any collateral to obtain the loan, and the interest rate you pay depends on your credit score. Consider this … as of January 2018 the average credit card interest rate was higher than 16 percent[1].

So even if a personal loan has a higher interest rate than a secured loan, it will oftentimes be lower than the interest rate on your credit cards. Additionally, after consolidating your credit card debt into one, you will only have to make payments to one entity rather than all of the different credit card providers you had before.

Last but Most Important … Pay Every Bill on Time

The single most important strategy to repair your credit today is to commit to paying every single bill you have on time, every time. Just one late payment of 30 days has the potential to drop your credit score by 90-110 points. So, to say this is the most important step is a bit of an understatement.

Closing

Your credit history good or bad can impact your ability to buy a home, purchase a car, get a better credit card, get cellphone coverage, and even impact the type of employment opportunities you may have.

Repairing your credit score will take some time. On average, negative comments and remarks on your credit report remain on your report for about 7 – 10 years. Remember that your credit history is really just a story that tells future lenders how you manage your financial affairs. And everyone likes a good comeback story.

If you are just starting your credit repair journey, you can use the strategies discussed above to navigate this process. My hope in writing this article is that after reading this, you will take some steps towards successfully repairing your credit score.

[1] https://www.creditkarma.com/credit-cards/i/loan-pay-off-credit-card-debt/