Purpose of this article: to help a graduate school student choose between three apartments.

Overview:

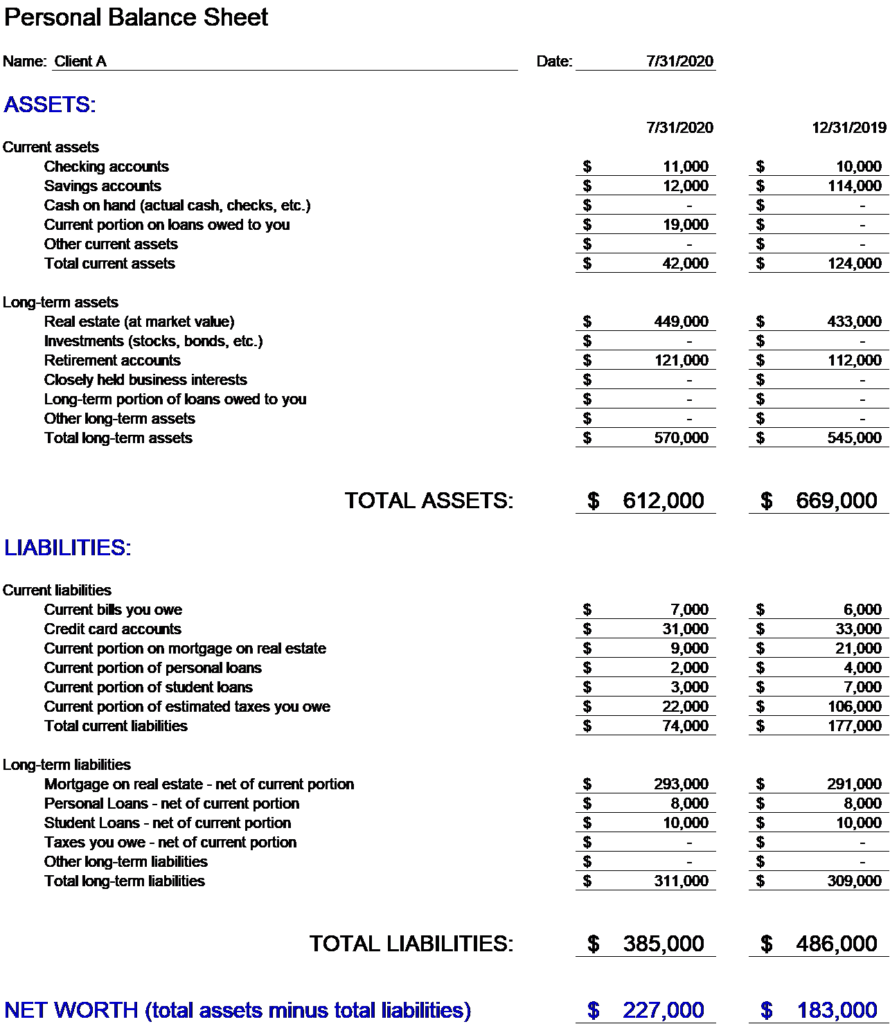

Sienna Nelson is on her way to UT Austin College of Pharmacy this coming Fall where she is pursuing her Pharm.D. degree. As mentioned before, the estimated total cost of attendance is $172,886 of which about $88,000 is budgeted for her cost of living (about $22,000 a year).

With a tight living budget, Sienna is trying to decide between three apartments with different monthly costs, levels of amenities, and distance to school.

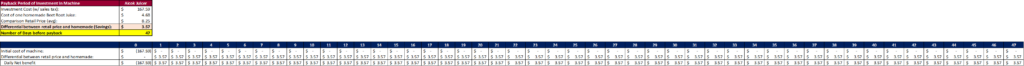

Below is a quick cash outflow analysis created to help her decide which apartment to go with. Excel file has been attached below and can be sent upon request.

Apartment 1: $945 monthly rent, no laundry or dryer:

Apartment 1 is a 5-minute walk from the bus stop that Sienna will take into school each day. Since she is very close to the bus stop, her plan is to save on fuel costs by walking to the park and ride each morning and taking the bus into school each day. The good thing for UT Students in Austin is that bus transportation is free for all students with an I.D.

Because her apartment under this scenario is a 5-minute walk from the bus, Sienna will walk to the park and ride each morning and not incur any additional travel cost.

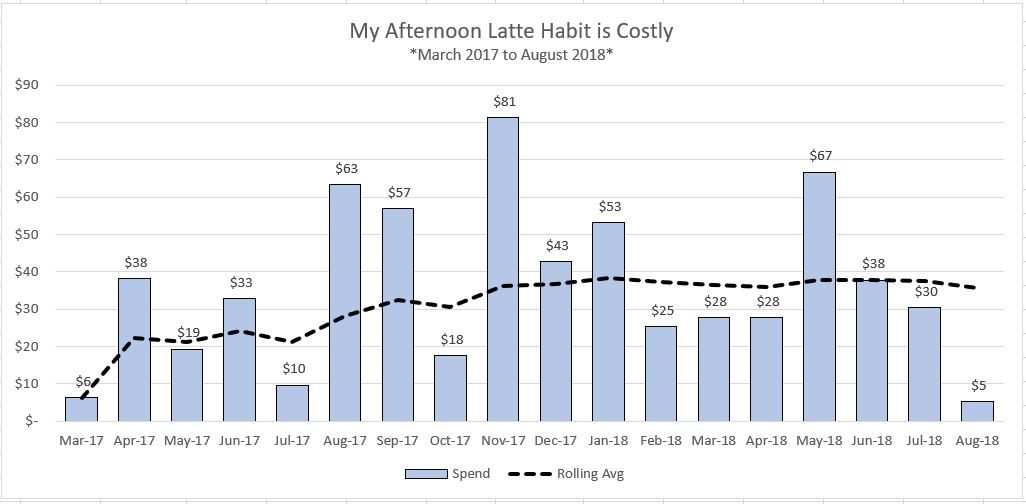

Since her apartment under this scenario doesn’t have a laundry or dryer machine in her unit, she will have to use the shared laundry and dryer machines downstairs. We estimate that it will cost her $30 a month. On top of that, every 3 months she will have to spend an additional $26 on detergent and dryer sheets.

Apartment 1, laundry, and travel to school each day is estimated to cost Sienna $11,752 each year. Over the next four years of school, that equates to $47,008.

Please note that these costs do not include utilities like electricity, heat, a/c, cable and internet, as we assume these expenses would be roughly the same in each scenario since the apartments are similar sized.

Apartment 2: $1,033 monthly rent, laundry & dryer:

Apartment 2 is a 1-mile drive from the bus stop that Sienna will take into school each day. Since she is semi-close to the bus stop, her plan is to save on fuel costs by driving a short distance to the park and ride each morning and taking the bus into school each day. The good thing for UT Students in Austin, is that bus transportation is free for all students with an I.D.

Because her apartment under this scenario is 1-mile away from the bus stop, Sienna will need to drive to the park and ride each morning. We estimate that will cost her $6 a month in fuel.

Since her apartment under this scenario does have a laundry and dryer machine in her unit, she will be able to save some. We estimate that it will cost her $8 a month in energy to wash and dry her clothing. On top of that, every 3 months she will have to spend an additional $26 on detergent and dryer sheets.

Apartment 2, laundry, and travel to school each day is estimated to cost Sienna $12,611 each year. Over the next four years of school, that equates to $50,445.

Please note that these costs do not include utilities like electricity, heat, a/c, cable and internet, as we assume these expenses would be roughly the same in each scenario since the apartments are similar sized.

Apartment 3: $940 monthly rent, laundry & dryer:

Apartment 3 is a 3-mile drive from the bus stop that Sienna will take into school each day. Since she is semi-close to the bus stop, her plan is to save on fuel costs by driving a short distance to the park and ride each morning and taking the bus into school each day. The good thing for UT Students in Austin, is that bus transportation is free for all students with an I.D.

Because her apartment under this scenario is 3-miles away from the bus stop, Sienna will need to drive to the park and ride each morning. We estimate that will cost her $18 a month in fuel.

Since her apartment under this scenario does have a laundry and dryer machine in her unit, she will be able to save some. We estimate that it will cost her $8 a month in energy to wash and dry her clothing. On top of that, every 3 months she will have to spend an additional $26 on detergent and dryer sheets.

Apartment 3, laundry, and travel to school each day is estimated to cost Sienna $11,639 each year. Over the next four years of school, that equates to $46,557.

Please note that these costs do not include utilities like electricity, heat, a/c, cable and internet, as we assume these expenses would be roughly the same in each scenario since the apartments are similar sized

Which Apartment Should She Choose?

Based on our pure financial analysis, we recommend that Sienna choose Apartment 3. It is -1.0% and -7.7% cheaper than Apartment 1 and Apartment 2 respectively. The summary table below shows a side by side comparison of the total cost of each apartment:

An argument could be made that Apartment 1 might be worth it holistically to Sienna because the difference in cost is only $113 a year, but it’s much closer to the bus stop and ultimately school. What we can all agree upon is that Apartment 2 is out of the equation and ultimately Sienna now has the tools necessary to make the best decision for herself!

Everyone’s situation is slightly different but please know that we at Blue Elephant Financial Services are here to help you make the best financial decisions possible.

Excel Link: Sienna Nelson – 3 Apartment Choices