Purpose of this article: to explain an effective strategy to reduce your taxable income and lower your annual taxes.

Overview:

Each year during tax planning with my clients, the inevitable question always arises:

How can I reduce my yearly tax bill?

And while it can seem like a daunting task, the reality is you can trim your tax bill right now by following this one simple and legal strategy:

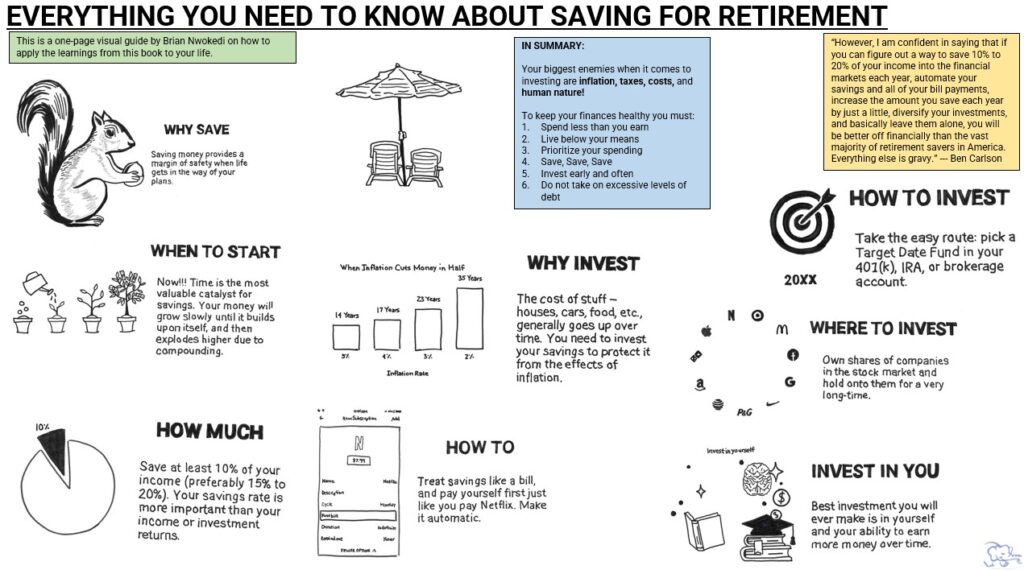

Increase your contribution to your employer sponsored retirement plan (i.e. 401(k), 403(b) or other retirement plan).

This simple but effective strategy will allow you to reduce your taxable income and save for retirement at the SAME TIME!

How Does This Actually Work?

The rules of the 401(k) employee sponsored retirement plan are such that you are legally allowed to contribute up to $18,000 annually before tax. And if you are 50 or older, the contribution max grows to $24,000. Each paycheck, your employer will take out money from your paycheck and put it directly into your 401(k) account. Since the money is taken “before tax” it isn’t counted as taxable income when you file your taxes in April.

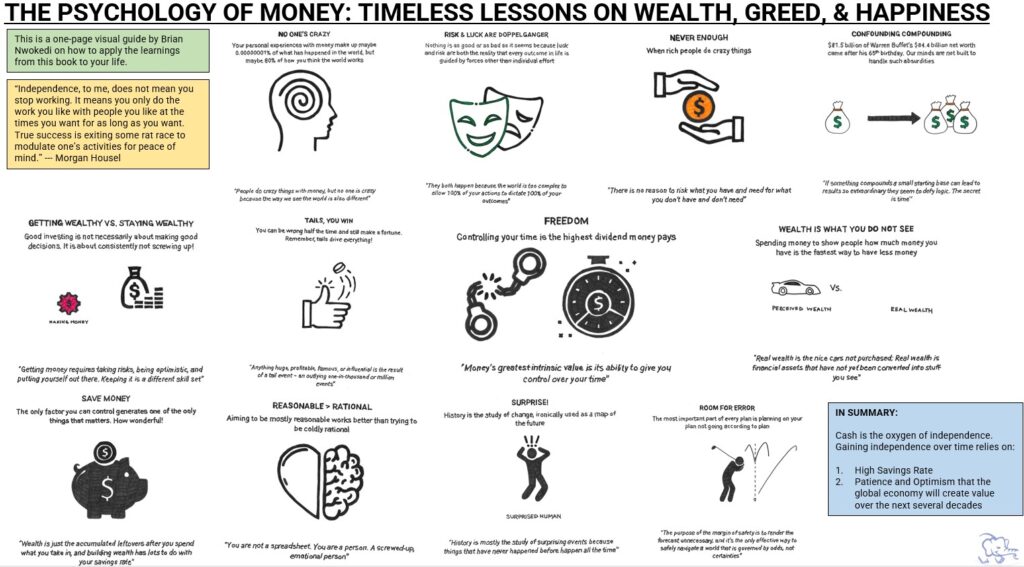

By increasing your 401(k) contribution, you are effectively deferring tax to a later date in retirement (thus reducing your tax today) because the money you put into the 401(k) goes in tax free, and isn’t taxed until you withdraw in retirement. Furthermore, you not only reduce the total amount you pay in income taxes, but also jump-start your retirement portfolio by putting all of your savings to work immediately.

Financial Example: Bess Napier

Bess makes $50,000 annually and has a 25% tax rate. She decides that she will contribute the maximum $18,000 annually to her 401(k). By doing this she reduces her taxable income down to $32,000 before any itemized deductions or credits, and she saves for retirement!

Put more specifically, investing $18,000 directly into a 401(k) each year grows your retirement nest egg quicker than getting paid the $18,000, paying 25% in taxes, and investing the $13,500 that is left.

For married couples, the math is exactly the same. Each person can contribute $18,000 taking the combined maximum to as much as $36,000. And a married couple over 50 can contribute a maximum of $48,000 ($24,000 each person).

Other Types of Employee Sponsored Retirement Plans

Please note that other employer sponsored retirement plans like a SIMPLE IRAs will have different contribution limits but function the same way as the 401(k). So if you are not maxing out your annual contribution amount, you are paying more taxes than you should. The chart below courtesy of Vanguard has all of the limits:

Courtesy of https://personal.vanguard.com/us/insights/taxcenter/contribution-limits

How can I get this same benefit if my employer doesn’t sponsor a retirement plan?

If you work for a company that does not have a sponsored retirement plan you can still take advantage of some tax deferral. You can open up an Individual Retirement Account (IRA) and make tax-deductible contribution to the IRA. The max contribution here is only $5,500, ($6,500 if 50 and over) which is much lower than the employee sponsored plans, but it is still better than nothing. The only potential problem with an IRA is the fact that tax deductibility phases out for individuals and couples at different levels of modified gross income. The following chart shows all of the various income ranges that cause IRA tax deductibility phase out:

Courtesy of the Hawaii Employees Council

While there are many factors to consider when determining whether or not you are subject to the income-phase out restrictions for IRAs, the point I want to make here is that there are many ways to reduce your taxable income and the best and simplest way to do this is to invest in some retirement vehicle before taxes (i.e. . 401(k), 403(b), other retirement plan, or Traditional IRA).

My hope in writing this article is that after reading this, you can now see the tax benefit of contributing to a retirement savings account. There is not easier way to reduce your tax liability today!