“However, I am confident in saying that if you can figure out a way to save 10% to 20% of your income into the financial markets each year, automate your savings and all of your bill payments, increase the amount you save each year by just a little, diversify your investments, and basically leave them alone, you will be better off financially than the vast majority of retirement savers in America. Everything else is gravy.” --- Ben Carlson (2020)

📚 Core Insight

- Building financial independence isn’t about complex investment strategies — it’s about mastering simple behaviors consistently over decades.

- The real drivers of retirement success are: saving early and often, automating your habits, resisting lifestyle inflation, and focusing relentlessly on what you can control (your savings rate and behavior) — not chasing high investment returns.

- Patience, discipline, and consistency—not brilliance—win the long game.

“Everything You Need to Know About Saving for Retirement“ by Ben Carlson is a succinct yet insightful guide that puts the spotlight on a fundamental aspect of retirement planning: your savings rate. In a world of complex investment strategies and ever-changing financial landscapes, Carlson distills his wisdom into a straightforward message – it’s not just about where you invest, but how much you save.

With a clear and approachable style, he emphasizes that building a secure retirement is within reach if you focus on increasing your savings and maintaining a consistent approach. Drawing on his expertise in personal finance, Carlson’s concise and no-nonsense approach empowers readers to take control of their financial destinies, offering a roadmap to achieving financial security during retirement through a smart savings strategy!

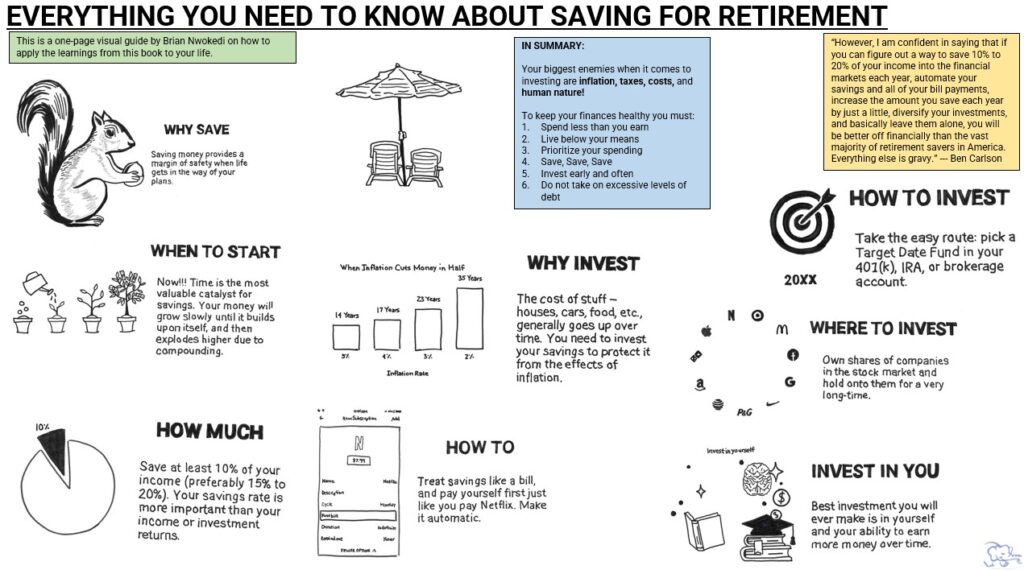

The following one-page visual guide has been created by me to help you apply the teachings from Ben’s book to your life. See below ?

Downloadable Content – Raw Notes

Ready to dive deeper into Ben Carlson’s work on Saving for Retirement? Download my unfiltered notes below ?